As I entered Day 5 of the fast, I started to lose steam. I wanted to return to my old habits. I didn’t realize I would feel this way so I hadn’t planned any way to combat what I now call my “spending” addiction.”

The financial fast was making me be more purposeful with my actions. As I reflected, I realized I let my emotions be the driver behind many of my purchases. For instance, if I “felt” tired I simple bought convenience food. When I was bored I would go to Target or some other store to have something to do.

Now I was using my budget so I didn’t spend money that wasn’t allocated to cleaning supplies, food, clothing, etc. But I wasn’t making fully consciences decisions with my money. My emotions were in control of the money I spent more than my mind was.

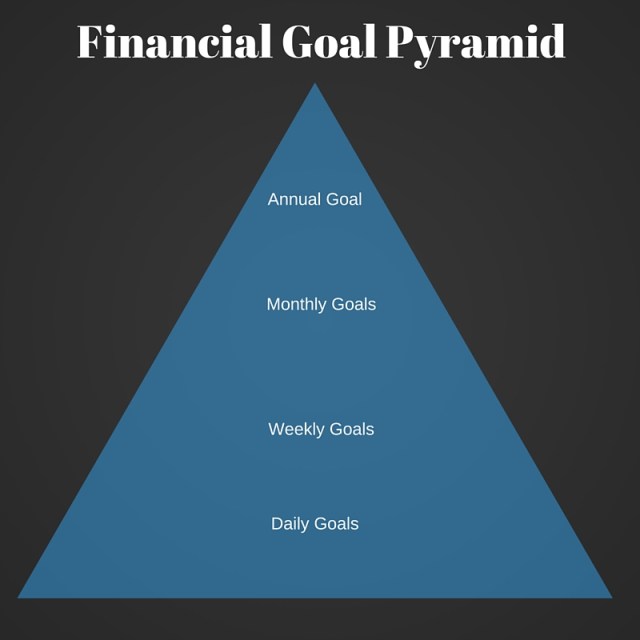

Anytime I wanted to go shopping or out to get food, I reminded myself I was on a financial fast. I also began to note when I would generally needed a shopping fix. I started becoming more focused on my financial goals. I started reviewing my goals DAILY! This aided in keeping me on track.

IMPULSE shipping is not your friend. You will end up with less cash and mostly items that decrease in value. I looked around my home and decided it was time to DECLUTTER all these items I didn’t use. I had items to be donated that included: wall art, clothing, irons, drapes, small kitchen, picture frames and so much more. This was stuff I bought, didn’t use or had duplicates of because of impulse buying.

I can now see CLEARLY! I must reign in my emotions to be a better steward of my money. While I still feel the “need” to buy, I now have a few methods to counteract the feeling. PROGRESS!